Japan’s next House of Representatives election is more than a domestic political event.

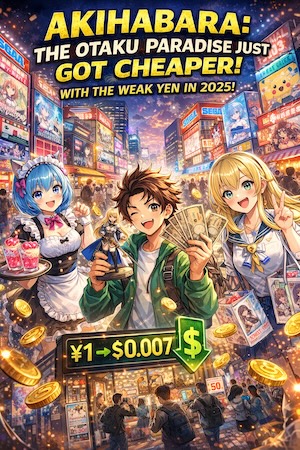

For global investors and pop-culture fans alike, it may mark the beginning of a new structural era of yen weakness—and unexpectedly, a boom time for Japan’s otaku economy.

This article explores how election outcomes, fiscal policy expectations, and currency dynamics could converge to create what might be called “Japan’s Otaku Paradise Era”—a period where anime, games, merchandise, and fan tourism become unusually affordable and attractive for overseas audiences.

This is not a prediction based on slogans or optimism, but a scenario built from market behavior, policy incentives, and past responses.

Please note that the content of this article is based on publicly available information, historical trends, and the author’s own rough estimates and scenario analysis.

It does not represent official policies, investment strategies, or funding plans of the Japanese or U.S. governments, nor does it predict actual movements in the foreign exchange market.

Financial markets are influenced by many complex and constantly changing factors.

Accordingly, the views presented here should be understood as one possible perspective, not a definitive interpretation of reality.

This article is intended as a casual, educational read, not as financial advice.

Readers are encouraged to approach it with a relaxed mindset and enjoy it as a way to think through ideas, rather than as a statement of fact.

What a long excuse? Lol…

- Elections, Policy Signals, and Market Expectations

- What Kind of U.S. Investment Is Japan Actually Making?

- Why the Yen Is Often “Defended in Words, Not in Deeds”

- When Expectations Move Faster Than Money

- What a Weak Yen Means for Global Otaku Culture

- “Otaku Paradise” as an Unintended Policy Outcome

- Conclusion: Not an Accident, but a Direction

Elections, Policy Signals, and Market Expectations

Japanese elections often influence markets less through campaign promises and more through what investors believe the government will tolerate.

A decisive election result tends to send a clear signal:

- Expansionary fiscal policy is politically acceptable.

- Currency weakness is not an urgent priority.

- Asset prices, especially equities, are implicitly supported.

Markets do not wait for formal policy changes.

They react to what appears politically convenient.

In recent years, yen depreciation has coincided with record highs in the Nikkei index. This has created a quiet but powerful lesson for policymakers:

a weaker yen may cause public discomfort, but a rising stock market stabilizes political support.

What Kind of U.S. Investment Is Japan Actually Making?

When Japanese officials talk about “investment in the United States,” it does not mean vague portfolio rebalancing or symbolic diplomacy.

It refers to specific, capital-intensive commitments that require large-scale dollar funding.

Based on publicly discussed frameworks and past execution patterns, these U.S.-bound investments are concentrated in four areas:

First, U.S. Treasury bonds and dollar-denominated government securities.

These serve both political and strategic purposes, reinforcing U.S. fiscal capacity while deepening Japan’s exposure to dollar assets.

Second, strategic industrial investment, particularly in semiconductors, AI infrastructure, and advanced manufacturing.

These projects often involve long-term capital lock-in and are aligned with U.S. supply-chain security priorities.

Third, energy and resource security, including LNG projects and energy-related infrastructure.

These investments are typically large-ticket, multi-year commitments settled in dollars.

Fourth, government-backed joint projects, where Japanese policy institutions support U.S. corporations or bilateral initiatives.

In practice, these are executed using existing foreign-currency deposits, not newly created funds.

Crucially, this means the funding source is not abstract.

It is foreign-currency deposits being mobilized and converted, tranche by tranche, into U.S.-bound capital.

The Numbers Behind the Capital Flow

Assuming an execution structure of ¥5 trillion per tranche, the scale becomes immediately visible.

At an exchange rate around ¥157 per dollar, a single ¥5 trillion tranche equals approximately $31.8 billion.

A full ¥80 trillion program equals roughly $509 billion in dollar demand.

Japan’s domestic FX market averages about $430 billion in daily turnover.

One ¥5 trillion tranche therefore represents around 7 percent of a full trading day.

After two or three confirmed tranches, markets do not treat this as a one-off event.

They treat it as a recurring dollar-buying schedule.

At that point, price action is no longer driven by each tranche itself, but by anticipation of the next one.

Why Markets Front-Run the Yen Weakness

Even if Japan holds large foreign reserves, the amount realistically deployable for repeated currency defense is limited.

If effective countermeasures amount to roughly ¥30 trillion, that equals six ¥5 trillion-sized responses.

Against a sixteen-tranche outbound investment program, the imbalance is obvious.

From a market perspective, the rational response is not to wait for official action.

It is to position ahead of it.

This is how gradual currency weakness turns into accelerated depreciation driven by expectation rather than execution.

Why the Yen Is Often “Defended in Words, Not in Deeds”

Japan has a history of foreign exchange intervention that looks dramatic—but is often limited in scope.

From the outside, officials may say:

“We have taken all possible measures.”

From the market’s perspective, however, two things are quickly assessed:

- The actual size of usable intervention funds.

- Whether the government has a real incentive to reverse the trend.

When investors conclude that authorities are managing optics rather than outcomes, currency defense becomes a short-term event, not a long-term barrier.

Once this pattern is recognized, speculative positioning tends to move ahead of official action, not after it.

When Expectations Move Faster Than Money

One of the most important dynamics in currency markets is this:

Anticipated flows often move prices more than actual flows.

If investors believe that:

- Large-scale overseas investment will continue,

- Authorities will not aggressively resist yen depreciation,

- And intervention capacity is finite,

then the market begins to price in future weakness immediately.

At that point, the exchange rate is no longer responding to trade flows alone—it is responding to collective belief.

This is how gradual depreciation turns into accelerated yen decline.

What a Weak Yen Means for Global Otaku Culture

Here is where politics and currency meet pop culture.

A structurally weak yen has very real consequences for overseas fans:

- Anime Blu-rays, figures, and limited goods become cheaper in dollar and euro terms.

- Japan-only merchandise feels suddenly “reasonably priced.”

- Travel costs relative to spending power drop.

- Event participation—anime expos, collaboration cafes, themed pop-ups—becomes more accessible.

In short, Japan becomes the best-value otaku destination in the world.

For international fans, this does not feel like economic instability.

It feels like a golden opportunity.

↓In this article, I tried to calculate how far the yen would depreciate.↓

USD/JPY 180? 200? Estimating the Yen’s Downside After Japan’s Election

“Otaku Paradise” as an Unintended Policy Outcome

No Japanese government campaigns on creating an otaku paradise.

Yet currency dynamics may do exactly that.

A weak yen:

- Encourages inbound tourism.

- Rewards content exports.

- Amplifies global fandom engagement.

What begins as a macroeconomic outcome ends up reshaping everyday consumer culture.

Anime, games, idols, and character goods are no longer niche imports—they become affordable gateways into Japanese culture.

Conclusion: Not an Accident, but a Direction

The coming yen environment should not be understood as a sudden crisis or a market failure.

It is better understood as a direction chosen through inaction, reinforced by political incentives and market interpretation.

For global fans, this may mean:

- More access,

- Lower barriers,

- And a prolonged era where Japan’s pop culture is easier to enjoy than ever before.

The age of a strong yen limited Japan’s cultural exports by price.

The age of a weak yen may do the opposite.

And for otaku around the world, that could feel like paradise.

All Write: Kumao

This article is a scenario-based analysis, not investment advice.

Exchange rates are influenced by multiple factors, and actual outcomes may differ from any estimate discussed here.