This article is a supplementary piece to “How Japan’s Recent Election Confirmed a Weak Yen — and Why Otaku Culture Benefits”

Before continuing, we strongly recommend reading the main article first, as it explains the political background, capital flow assumptions, and currency mechanics in detail.

This follow-up builds on that foundation and focuses specifically on how far the yen could realistically weaken, using the same numerical framework.

Please note that the content of this article is based on publicly available information, historical trends, and the author’s own rough estimates and scenario analysis.

It does not represent official policies, investment strategies, or funding plans of the Japanese or U.S. governments, nor does it predict actual movements in the foreign exchange market.

Financial markets are influenced by many complex and constantly changing factors.

Accordingly, the views presented here should be understood as one possible perspective, not a definitive interpretation of reality.

This article is intended as a casual, educational read, not as financial advice.

Readers are encouraged to approach it with a relaxed mindset and enjoy it as a way to think through ideas, rather than as a statement of fact.

Okay, enough. You’re really pushing it.” Lol…

- Estimating the Weak Yen Era After Japan’s General Election

- The Fixed Assumptions Behind the Scenario

- Converting the Numbers Into Market Scale

- Why the Third Tranche Matters More Than the Sixteenth

- Estimating the Exchange Rate Impact

- Scenario-Based Yen Projections

- Why Authorities May Accept the Outcome

- What This Means for Global Otaku Culture

- Conclusion: Not an Accident, but a Range

Estimating the Weak Yen Era After Japan’s General Election

“How far can the yen actually fall?”

This is no longer a fringe question asked only by currency traders.

After Japan’s general election, markets are increasingly focused on a specific combination of factors:

large-scale U.S. investment, limited currency defense capacity, and a political environment that appears comfortable with yen weakness.

This article does not rely on abstract theory.

It uses explicit numbers, execution assumptions, and market behavior to estimate where the yen could realistically go—and why that matters even for anime fans and otaku consumers worldwide.

The Fixed Assumptions Behind the Scenario

To avoid vague speculation, this estimate is built on a clearly defined framework.

- Total U.S.-bound investment: ¥80 trillion

- Execution method: ¥5 trillion per tranche

- Number of tranches: 16

- Funding source: mobilization of foreign-currency deposits

- Market behavior: front-running begins around the third tranche

- Effective counter-intervention capacity: approximately ¥30 trillion (six tranches)

- Political stance: yen weakness tolerated, not aggressively reversed

These assumptions reflect how markets interpret policy behavior, not official slogans.

Converting the Numbers Into Market Scale

At an exchange rate around ¥157 per dollar:

- ¥5 trillion ≈ $31.8 billion

- ¥80 trillion ≈ $509 billion

- ¥30 trillion ≈ $190.7 billion

Japan’s domestic FX market averages roughly $430 billion in daily turnover.

That means:

- One ¥5 trillion tranche equals about 7% of a full trading day

- Three tranches equal nearly a quarter of daily volume

- The full program equals more than one full day of domestic FX turnover

This is why markets do not wait for all sixteen tranches to be executed.

Why the Third Tranche Matters More Than the Sixteenth

Currency markets are driven less by completed flows than by expected flows.

Once investors confirm that:

- capital is moving in fixed-size tranches,

- the source is real dollar demand,

- and countermeasures are finite,

the rational response is to buy dollars ahead of schedule.

By the third tranche, the story shifts from “possible” to “predictable.”

From that point on, price action reflects anticipation, not execution.

Estimating the Exchange Rate Impact

Based on past Japanese intervention episodes and non-intervention periods, a useful rule of thumb is:

- ¥5–10 trillion of one-directional pressure → 5–10 yen of movement

This is not a precise formula, but an observed range.

In this scenario:

- The total real flow is ¥80 trillion

- Market anticipation can easily amplify this beyond ¥100 trillion equivalent

- Counter-intervention is capped around ¥30 trillion

This imbalance defines the range.

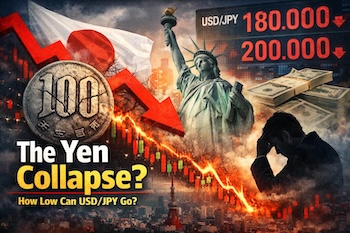

Scenario-Based Yen Projections

Base Scenario: Structural Weakness Becomes Consensus

- Front-running begins early

- Official resistance is limited and symbolic

- Equity markets remain strong, reinforcing tolerance

Estimated range: USD/JPY 180–190

This level represents a point where markets collectively accept that yen defense is no longer a priority.

Accelerated Scenario: Momentum Takes Over

- Hedge funds, CTAs, and options traders join

- A visible intervention attempt fails

- Volatility spikes, but direction remains one-sided

Estimated range: USD/JPY around 200 (with temporary overshoots)

At this stage, expectations drive price more than capital flows.

Extreme but Coherent Scenario: Currency Repricing

- U.S. rates stay high

- Japan remains unable to normalize policy

- Political incentives continue to favor asset inflation

Estimated range: USD/JPY approaching 220

This is not a crisis spike, but a revaluation phase.

Why Authorities May Accept the Outcome

A weak yen has already coincided with:

- record highs in the Nikkei 225,

- rising corporate profits,

- and improved nominal growth indicators.

From a political standpoint, this trade-off is clear:

- currency weakness causes discomfort,

- asset appreciation stabilizes support.

Markets understand this incentive structure—and price accordingly.

What This Means for Global Otaku Culture

For overseas fans, a structurally weak yen changes everyday economics.

- Anime figures become cheaper in dollar terms

- Limited-edition merchandise feels accessible

- Japan-only goods lose their premium barrier

- Travel budgets stretch further

What looks like macroeconomic imbalance becomes a consumer windfall.

A weak yen does not just move charts.

It reshapes how global fans experience Japanese pop culture.

Conclusion: Not an Accident, but a Range

The yen’s potential decline is not a mystery.

It is a function of numbers, incentives, and expectations.

Under the current structure:

- 180–190 is a realistic stabilization zone

- 200 is reachable under momentum

- Beyond that, limits depend less on policy and more on belief

For global otaku, this may mark the beginning of an unusually accessible era.

A weak yen, unintentionally, could create Japan’s next pop-culture golden age.

All Write: Kumao

This article is a scenario-based analysis, not investment advice.

Exchange rates are influenced by multiple factors, and actual outcomes may differ from any estimate discussed here.